Inflation in Latin America: The scale of the problem

In this table below we provide the latest official inflation rates for the countries in the region [1].

| Country | Last (%) | Previous (%) | Reference |

| Argentina | 31.3 | 31.8 | Oct/25 |

| Aruba | -0.4 | -0.8 | Sep/25 |

| Bahamas | 0.3 | -0.4 | May/25 |

| Barbados | 1.2 | 1 | Aug/25 |

| Belize | 0.6 | 0.8 | Sep/25 |

| Bermuda | 1.7 | 1.8 | Jun/25 |

| Bolivia | 22.23 | 23.32 | Oct/25 |

| Brazil | 4.68 | 5.17 | Oct/25 |

| Cayman Islands | 1.9 | 1.8 | Jun/25 |

| Chile | 3.4 | 4.4 | Oct/25 |

| Colombia | 5.51 | 5.18 | Oct/25 |

| Costa Rica | -0.38 | -1 | Oct/25 |

| Cuba | 15.2 | 15.21 | Sep/25 |

| Dominican Republic | 3.76 | 3.71 | Sep/25 |

| Ecuador | 1.24 | 0.72 | Oct/25 |

| El Salvador | 0.94 | 0.36 | Oct/25 |

| Guatemala | 1.26 | 1.47 | Oct/25 |

| Guyana | 3.8 | 4.1 | Sep/25 |

| Haiti | 31.9 | 31.1 | Sep/25 |

| Honduras | 4.85 | 4.55 | Oct/25 |

| Jamaica | 2.1 | 1.2 | Sep/25 |

| Mexico | 3.57 | 3.76 | Oct/25 |

| Nicaragua | 2.48 | 1.4 | Sep/25 |

| Panama | -0.25 | -0.36 | Sep/25 |

| Paraguay | 4.1 | 4.3 | Oct/25 |

| Peru | 1.35 | 1.36 | Oct/25 |

| Puerto Rico | 1.9 | 1.7 | Sep/25 |

| Suriname | 10.7 | 10.8 | Sep/25 |

| Trinidad and Tobago | 1 | 1.4 | Sep/25 |

| Uruguay | 4.32 | 4.25 | Oct/25 |

| Venezuela | 172 | 136 | Apr/25 |

As we can see in the table, Venezuela, Argentina, Bolivia and Cuba face very high inflation rates, while other countries in the region such as Brazil, Uruguay and Mexico register more moderate rates. In some countries the inflation rate is quite low, such as in Costa Rica, Belize and El Salvador.

However, these numbers alone do not tell the full story. What matters is what drives inflation, and how inflation evolves and or persists over time, translating into lost purchasing power, eroding savings and creating unstable living standards.

Why inflation remains stubborn in certain countries

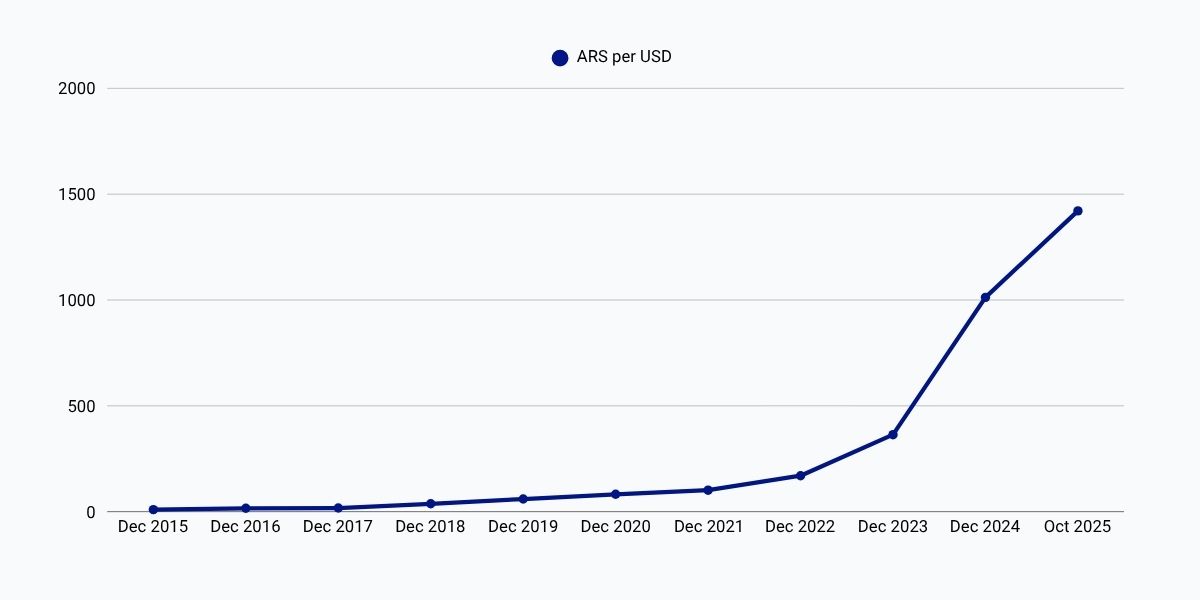

Take Argentina. Inflation hit over 200% at the end of 2023 after more than a decade of strong inflation, with annual price increases running above 20-40% through most of the 2010s, then accelerating to 47.6% in 2018, 53.8% in 2019, 50.9% in 2021 and finally exploding to 94.8% [2]. Just to give an example of what +200% inflation means, In Buenos Aires, Argentina: a liter of super petrol began the year at 150.90 pesos and by the end of the year it reached 553 pesos, representing an increase of = 266% [3].

One reason inflation was so extreme in Argentina is monetary financing of deficits: the central bank repeatedly accommodated large fiscal deficits by expanding the money supply [4]. Other contributing factors include currency devaluation, weak institutions, and expectations that inflation will keep going. In short: when people expect high inflation, they also act in ways that tends to perpetuate it [5].

The Argentinian inflation rate declined to 30–35 % in 2025. This was largely driven by the new policies introduced by Javier Milei’s administration which on one side drastically cut government spending and committed to a zero-deficit policy, which halted large-scale money printing and helped bring inflation down [6]; and on the other side liberalized the economy ending currency controls and opening up imports, thus restoring market confidence and contributing to price stability.

That drop is significant, but that still means prices increase roughly one-third per year.

In Venezuela the situation has been more extreme. A long-running economic, political and institutional crisis combined with collapsing oil production, massive fiscal deficits, heavy money creation and currency collapse have produced hyperinflation.

Bolivia had a period of relatively low inflation for years, but more recently inflation has jumped into the low-to-mid twenties percent range. The drivers include fiscal deficits, currency devaluation, and rising import prices due to shortages of export revenues and dollar liquidity.

Then there are moderate-inflation countries, but erosion still matters. Consider Brazil. With inflation at ~5 % in 2025, it might look under control. But even moderate inflation steadily reduces purchasing power over time. For example, a basket costing 100 BRL today will cost ~105 BRL next year if inflation is 5 %. If wages or savings don’t rise at the same pace, the real-value of income falls. Over five years this compounds: at 5 % annual inflation, prices will be ~28 % higher after five years. That means you’ll need ~28 % more nominal income just to stay at the same real standard of life.

Why inflation pushes people towards more stable stores of value

When inflation persists year after year, people start thinking less about returns and more about protecting the value of what they already have. In many Latin American economies, the local currency loses purchasing power faster than salaries or savings can keep up. This encourages families to look for alternatives that hold value more reliably.

The most traditional escape route is the US dollar. Decades of experience taught people in Argentina, Venezuela, Bolivia and several other countries that the dollar keeps its value much better than the local currency. Even the dollar has lost purchasing power over time, but the rate of erosion is quite slow and predictable [7] when compared to the rapid depreciation of many Latin American currencies. For someone watching prices climb 20 or 30 percent per year, the idea of holding cash that loses two or three percent a year feels safer.

In the last five years, digital access to dollars created a new option: stablecoins such as USDT and USDC. These tokens are designed to maintain parity with the US dollar and are easy to store, send and exchange. The appeal is straightforward. People can hold value in a form that behaves like a dollar, move it without relying on local banking systems and use it instantly for online payments or peer transfers. This combination of stability and usability makes stablecoins attractive for anyone living in an inflationary environment.

Bitcoin also plays a role. Many individuals view it as a long term store of value, especially in countries where confidence in the local currency is low. Daily spending in bitcoin is still uncommon due to volatility, so most people treat it as a savings instrument rather than a substitute for cash. Stablecoins fill the gap for everyday use, while bitcoin serves as a hedge and a longer horizon asset.

As inflation compounds year after year, the logic becomes simple. A family that keeps its money in pesos or bolívares watches its purchasing power shrink. A family that keeps part of its savings in dollars or stablecoins feels more protected. The rapid spread of digital wallets in Latin America made this transition easier. Anyone with a smartphone can now store and move value in a currency that holds up much better than their own.

This change in habits helps explain why so many people in the region now keep part of their money in stablecoins [8]. Most are not trading cryptocurrencies or looking for quick gains. They just want their income and savings to hold their value and to be able to cover everyday needs without worrying that prices will jump again next month. Stablecoins give them a simple way to do that in a place where inflation never feels far away.

Stablecoin adoption in Latin America

Stablecoins are rapidly gaining traction across Latin America, not just as speculative assets but as practical tools for payments, payroll, treasury and everyday transactions. The region’s unique economic conditions, such as persistent inflation, currency devaluation and fragmented banking infrastructure, make stablecoins especially attractive for businesses and individuals.

Strong adoption metrics and institutional readiness

According to a 2024 report from Chainalysis, Latin America represented 9.1% of global cryptocurrency value received between July 2023 and June 2024 (= US$415 billion). [8] This growth was driven strongly by companies, institutions and retail users in countries such as Argentina, Brazil and Venezuela.

A survey by Fireblocks [9] found that in Latin America: 86% of institutions already had partnerships to support stable-coin integration, 71% said their infrastructure (wallets, APIs) was ready for stablecoins, and only 7% cited lack of internal expertise as a barrier.

Use cases: payroll, treasury, cross-border payments

Stablecoins are increasingly used by payroll and treasury functions in Latin America. For instance, companies such as Mural Pay and Bitso (in Argentina and Colombia) are enabling contractors and workers to receive payments in stablecoins, bypassing delays and conversion losses in local currencies [10]. A related trend: stablecoins now account for about 39% of cryptocurrency activity in Latin America [11]. Treasury functions at fintechs and traditional companies are also using stablecoins to manage cross-border payments, FX hedging and treasury settlement. A 2025 "Stablecoin Landscape" study by Bitso Business reported that the volume of stablecoin usage among institutional clients had doubled from H2 2024 to H1 2025, with Mexico leading at 47% share and strong growth visible in Brazil, Colombia and Argentina. [12]

Why this matters for everyday users

For a freelancer in Latin America the difference is tangible: instead of waiting days and losing value through conversion to pesos or bolívares, they can receive payment in USDT or USDC, move it instantly, and spend or save it with greater confidence. For a business, paying contractors in stablecoins reduces FX risk, delays, intermediary fees and the dread of local currency depreciation.

This has meaningful implications for wealth preservation, spending power and financial inclusion.

Challenges and caveats

Despite these strong signals, there are obstacles. Regulatory clarity around stablecoins remains nascent in many countries, local fiat-on/off ramps may still be weak, and some users must still convert stablecoins back into local currency to spend in offline stores. Adoption is real, but for full every-day usage (e.g., retail purchases in local currency with stablecoins), infrastructure and merchant readiness are still scaling.

Earning and spending stablecoins in Latin America

Stablecoins are no longer just a savings tool in Latin America. They are becoming a form of income and a practical way to pay for everyday expenses. This shift began with freelancers and remote workers who needed faster and more reliable payments from abroad. It has since expanded into companies, startups and even small businesses that use stablecoins to pay contractors, handle cross-border operations and hold short-term reserves.

Freelancers were among the first to adopt this model. Developers, designers and digital workers across Argentina, Colombia and Brazil realized that receiving payment in USDT or USDC protected them from losing value between invoice and payday. Many salaries arrive from international clients, so receiving stablecoins directly avoids delays and prevents conversion into a weakening local currency. Platforms such as Bitwage and Mural Pay report steady growth in Latin American payroll flows. Companies including Bitso for Business enable firms to pay contractors in stablecoins without relying on the traditional banking rails that often involve long settlement times.

Some workers choose to keep their income in stablecoins as savings. Others convert part of it into local currency when needed. A growing number use stablecoins to make direct purchases online. The process is simple: stablecoins arrive on a wallet, and users either spend them through platforms that accept crypto or exchange small amounts at a time to cover daily costs. This offers a degree of control that is difficult to achieve with unstable local currencies.

Stablecoins also solve issues for small companies in the region. For a business owner in Buenos Aires or Caracas, receiving payments or holding reserves in local currency can mean watching working capital shrink week after week. Storing part of their treasury in USDT or USDC provides stability, especially during periods when prices and exchange rates move unpredictably. When suppliers or contractors accept stablecoins, payments settle instantly and avoid the friction of bank transfers or FX spreads.

Spending stablecoins directly is becoming more common, although acceptance still depends on the service or platform used. This is where companies like Cryptorefills come in. People can use the stablecoins they earn to buy gift cards, mobile airtime, digital services, travel products and other essentials. It turns stablecoins from a savings tool into a spending tool, giving users a way to convert their income into real goods without going through a bank or losing value in unnecessary currency conversions.

Stablecoin income and spending are growing for practical reasons. People want to protect what they earn, pay less in fees, move money quickly and keep control of their finances. In an environment where local currencies often feel unreliable, stablecoins offer a direct and predictable alternative.

[1] Trading Economics. (n.d.).Inflation rate – by country (Americas). https://tradingeconomics.com/country-list/inflation-rate?continent=america

[2] Wikipedia contributors. (2023). Economy of Argentina. In Wikipedia, The Free Encyclopedia. https://en.wikipedia.org/wiki/Economy_of_Argentina

[3] Buenos Aires Times. (2023). January starts with transport fare hike. https://www.batimes.com.ar/news/argentina/january-starts-with-transport-fare-hike.phtm

[4] Reed College, Department of Economics. (n.d.). Argentina: A case study. https://www.reed.edu/economics/parker/f13/201/cases/Argentina.html

[5] The Daily Economy. (2023). Argentina’s rampant inflation explained in one chart. https://thedailyeconomy.org/article/argentinas-rampant-inflation-explained-in-one-chart

[6] Stefoni, C. (2024). From Milei’s zero fiscal deficit towards a stabilisation plan to eradicate inflation: Why now? Real Instituto Elcano. https://www.realinstitutoelcano.org/en/analyses/from-mileis-zero-fiscal-deficit-towards-a-stabilisation-plan-to-eradicate-inflation-why-now/

[7] U.S. Bureau of Labor Statistics. (2024). CPI inflation calculator. https://www.bls.gov/data/inflation_calculator.htm

[8] Chainalysis. (2024). Latin America cryptocurrency report 2024. https://www.chainalysis.com/blog/2024-latin-america-crypto-adoption

[9] Fireblocks. (2024). Execution in motion: How Latin America is leading stablecoin adoption. https://fireblocks.com/blog/execution-in-motion-how-latin-america-is-leading-stablecoin-adoption/

[10] OneSafe. (2023). Crypto payroll in the USA and Latin America: The complete guide. https://www.onesafe.io/blog/crypto-payroll-usa-latin-america

[11] Rapyd. (2024). Latin America stablecoin payments. https://www.rapyd.net/blog/latin-america-stablecoin-payments/

[12] Bitso Business. (2025). Stablecoin landscape in Latin America: First half 2025. https://business.bitso.com/ebook/stablecoin-landscape-in-latin-america-first-half-2025